FOLLOW:

The best way to increase cashflow before the busy season

If you run a small business in South Africa, you already know that the last few months of the year are a rollercoaster. It’s the season when orders multiply, clients move deadlines around like puzzle pieces, and suddenly everyone wants everything yesterday. Cashflow can feel like the one friend or partner who ghosts you right when you need them most. But here’s the thing your business doesn’t have to buckle under the pressure. With a few smart moves, you can turn this chaotic season into your most profitable one yet. We’re going to give you all the tips you need to make sure you secure cash right before the busy season starts, but let’s start off with the basics, understand what cashflow is, and then jump into how you can improve yours.

What is Cashflow?

Think of cashflow as your business’s pulse. It’s the rhythm of money coming in and going out, and when it skips a beat, everything feels it. Positive cashflow means more money is coming in than going out, while negative cashflow means the opposite, you’re spending faster than you’re earning. And “potential profits” won’t pay rent or salaries. Only cashflow keeps the lights on. Even a profitable business can crash if cashflow dries up, so keeping it healthy isn’t optional. It’s survival

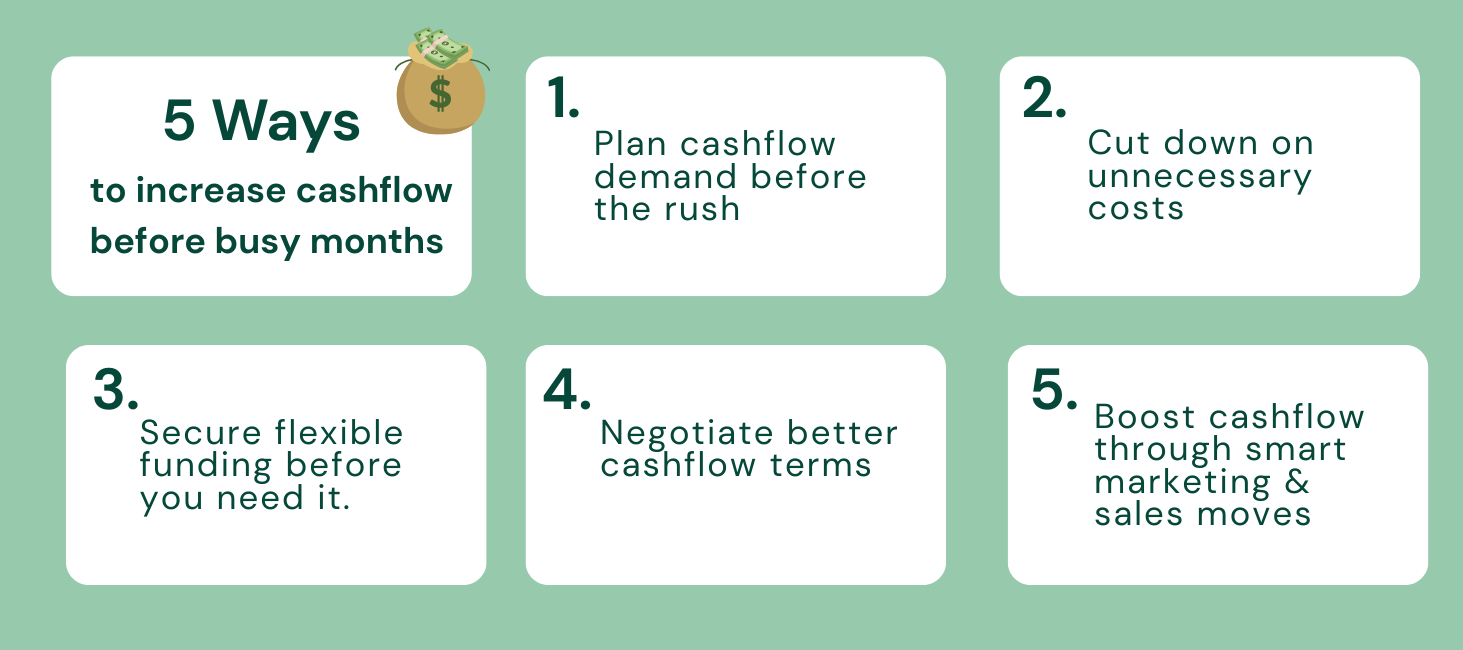

So, where can you make a start on improving your cashflow issues, we’ve rounded up 5 steps to improve your cashflow:

Step 1: Plan cashflow demand before the rush

Before you rush into December, take a minute to look back. Reflecting on last year gives you clues about what’s coming.

Ask yourself:

Key questions to ask when doing a cashflow audit:

• Which weeks or months were the busiest?

• What products or services had the highest demand?

• Did you run out of stock, staff, or capacity when you needed them most?

• Which clients delayed payments or required last-minute work?

Whether you sell products or services, forecasting helps you stay one step ahead.

For retailers, that means planning inventory, pricing, and marketing around expected spikes. For service businesses, it’s about mapping project timelines, securing short-term staff, or managing client retainers to keep income steady.

Creating a simple cashflow calendar also helps. Map when money will come in from sales or invoices, and when it’ll go out for salaries, rent, or supplier payments. It’s like giving your business a diary instead of letting chaos run the show.

Step 2: Cut down on unnecessary costs

Plugging the leaks in your cashflow doesn’t require a degree in finance. It’s mostly about being intentional and strategic with how money moves through your business. Send invoices as soon as a job is complete and set up automated reminders so you’re not chasing payments while juggling everything else. Encourage clients to pay faster by offering small early-payment discounts, even 2% can make a huge difference. Negotiate better terms with suppliers you trust, hire seasonal staff and cut expenses that don’t contribute real value, like unused subscriptions or unnecessary data packages. You’re not shrinking your business; you’re giving it space to breathe and keeping the flow steady Use performance-based bonuses instead of flat overtime and forecast labour costs weekly to stay ahead. You want your team energised, not exhausted, and your budget intact.

Step 3: Secure flexible funding before you need It.

This is the part people skip, then regret. The worst time to apply for funding is when you’re already in a crunch. Lenders can spot stress in your numbers, and approvals can slow down just when you need things to move fast.

Here’s what to do instead:

• Apply when your books are balanced and steady.

• Compare options before you’re desperate.

• Use FundingHub it connects you to over ten funding options with over sixty vetted South African lenders with just one application.

Different funding types serve different needs, so it helps to know your options.

Retail & E-commerce: A merchant cash advance or credit facility gives retailers upfront capital to buy stock before peak season and repay through future card sales.

Services & events: Invoice finance or unsecured loans help service-based businesses cover expenses while waiting for client payments, keeping operations running smoothly.

Construction & manufacturing: equipment, purchase order, or trade finance help fund machinery, confirmed projects, and imports, ensuring work continues without disruption.

Hospitality & tourism: working capital loans help cover staff, supplies, or refurbishments during seasonal highs and lows.

Property & contracting: property development and bridging finance keep projects on track by covering gaps between payments or transfers.

With FundingHub, you can access all these options through one simple application and find the funding that fits your business best.

Step 4: Negotiate better cashflow terms

Even with the best planning, sometimes you still need a financial boost. That’s where FundingHub comes in. Instead of chasing multiple lenders or trying to decode confusing bank jargon, you can compare funding options side by side, all in one place. Whether you’re looking for working capital to cover invoices, bridging finance to handle supplier payments, or an equipment loan to upgrade before the rush, FundingHub helps you find the right fit fast. It’s funding that moves at your pace, not the bank’s.

Step 5: Boost cashflow through smart marketing & sales moves

Your marketing and sales strategy isn’t just about getting noticed, it's about keeping the cash flowing. The goal is simple: make it easier for customers to say yes and faster for payments to land in your account.

Start with your current customers They already trust you, so reward loyalty with bundles, flash deals, or early-access discounts. If you’re a service business, offer retainer packages or pre-booking specials that bring money in upfront. For retail, create “buy now, enjoy later” campaigns that secure sales before the rush begins.

Use digital marketing to your advantage, a simple email reminder or a paid social ad targeting your warm audience can do wonders for conversions. Also, make sure your website and payment systems are frictionless; nothing kills a sale faster than a complicated checkout or outdated quote process.

Finally, track your marketing ROI like you track expenses. Every rand you spend on promoting your business should either bring in new clients, repeat purchases, or improved visibility that translates to future sales.

Remember: good marketing doesn’t just fill your pipeline, it fuels your cashflow.

Cashflow is queen

To stay steady through the festive rush, remember when opportunity shows up in December, you want to say yes without checking your balance twice.

Ready to strengthen your cashflow?

Find the right funding in minutes, not months. To make sure you stay on top of your cashflow and are ready for summer.

Whether you’re preparing for retail madness, event season, or year-end expansion, FundingHub helps you keep the money moving so your business never misses a beat.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)